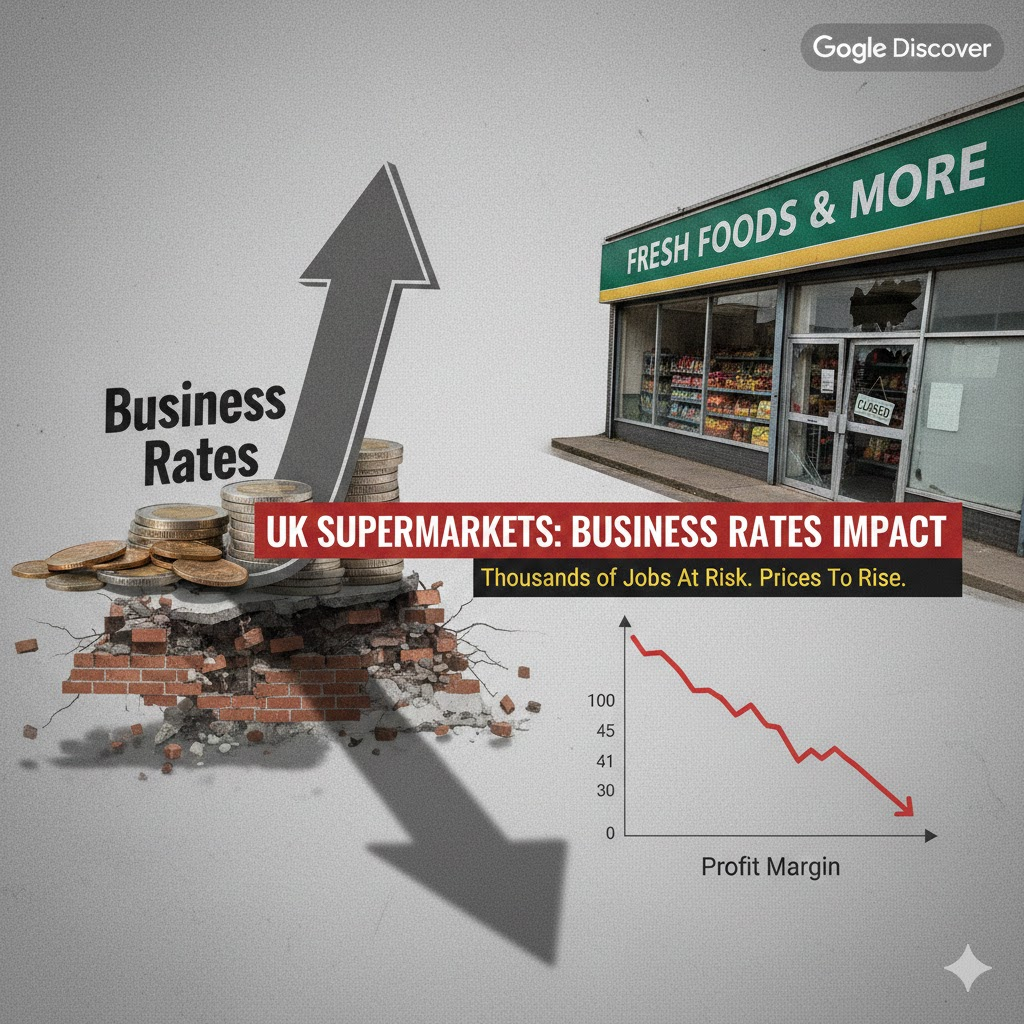

The uk supermarket business rates impact is emerging as one of the most significant concerns for both retailers and consumers in the UK. Rising business rates for large supermarkets increase operating costs, which can affect pricing strategies and store investment. Shoppers are likely to notice the effects in the form of higher grocery bills, while supermarkets face pressure to maintain profitability under new tax burdens.

Supermarkets are vital to the UK economy, providing employment to thousands and supplying essential goods to communities nationwide. The uk supermarket business rates impact threatens not only profits but also investment plans, expansion projects, and store modernisation. As taxes rise, large retailers may have limited flexibility to absorb costs, forcing adjustments in pricing or potentially reducing services offered to customers.

Understanding business rates in the UK

Business rates are a tax levied on commercial properties, including supermarkets, and are calculated based on property value. The uk supermarket business rates impact demonstrates how such taxes can significantly increase fixed costs for large grocery chains. While smaller retailers often benefit from relief schemes, large supermarkets face substantial increases, challenging their thin profit margins and operational budgets.

Historically, supermarkets have operated on low margins, using scale and efficiency to maintain competitiveness. The uk supermarket business rates impact now threatens this balance, as the additional costs could force supermarkets to reconsider expansion plans or delay store improvements. In some cases, the burden may even result in store closures, impacting employees and local shoppers.

How rising business rates affect supermarkets

The uk supermarket business rates impact is particularly visible in operational expenses. Large chains such as Tesco, Asda, and Sainsbury’s may struggle to cover the rising tax burden without passing costs to consumers. Increased business rates can reduce the available budget for store improvements, marketing, and customer services, ultimately affecting the overall shopping experience.

Supermarkets may respond by adjusting food prices to maintain profitability. The uk supermarket business rates impact also affects long-term strategic decisions, including opening new branches or expanding existing stores. Retailers operating under higher taxes may prioritise efficiency and cost-saving measures, sometimes at the expense of customer convenience or product variety.

Consequences for consumers

Consumers are directly affected by the uk supermarket business rates impact through higher grocery prices. As supermarkets transfer additional costs onto shoppers, everyday essentials such as milk, bread, and fresh produce could become more expensive. This could further exacerbate household budgets and contribute to wider food inflation across the UK.

The rising cost of groceries may also reduce consumer choice. The uk supermarket business rates impact could lead to store closures or downsizing in less profitable locations, forcing customers to travel further or switch brands. Lower availability of certain products and fewer stores can make shopping less convenient, impacting communities and their access to essential goods.

Wider economic and high street implications

The uk supermarket business rates impact extends beyond pricing, affecting employment and local economies. Increased operating costs may result in job reductions within supermarkets, warehouses, and distribution networks. Communities that rely on supermarket employment could experience economic strain, highlighting how taxation policies affect not only retailers but also the wider population.

Additionally, reduced investment in supermarket infrastructure may impact suppliers and smaller businesses in the supply chain. The uk supermarket business rates impact can indirectly influence product availability, competition, and innovation, creating ripple effects throughout the retail sector. The vitality of high streets may also decline if large stores struggle to maintain operations under heavier tax burdens.

Government response and industry reactions

Supermarkets have raised concerns about the uk supermarket business rates impact, urging the government to introduce reliefs or exemptions. Trade bodies and industry groups argue that rising business rates risk increasing food prices, affecting both consumers and the overall retail ecosystem. Public pressure has intensified discussions around balancing taxation and economic stability.

Despite industry lobbying, the Treasury has signalled a commitment to tax reforms aimed at broader economic benefits. However, retail leaders warn that without careful management of the uk supermarket business rates impact, high streets may suffer, store closures could increase, and inflationary pressures may worsen. Policymakers face the challenge of supporting both businesses and consumers.

Future outlook

Looking forward, the uk supermarket business rates impact will continue to shape the retail landscape. Supermarkets may adopt efficiency-focused strategies, including automation, streamlined operations, and cost optimisation. The balance between managing rising taxes and maintaining competitive pricing will define the future of UK grocery retail.

Consumers can expect continued monitoring of food prices and potential adjustments in purchasing habits. The uk supermarket business rates impact underscores how taxation, business strategy, and consumer behaviour intersect. Retailers, policymakers, and shoppers alike must navigate these changes to mitigate negative effects on the economy and daily life.

Conclusion

The uk supermarket business rates impact is a critical issue influencing retailers, consumers, and local economies. Rising taxes are likely to increase food prices, affect supermarket operations, and reshape the high street. Understanding this impact helps both businesses and consumers make informed decisions, highlighting the interconnected nature of taxation, retail strategy, and household spending.

FAQs

What is the uk supermarket business rates impact?

The uk supermarket business rates impact refers to how increases in business taxes affect large grocery retailers. Higher business rates raise operational costs, which can lead supermarkets to raise food prices, reduce investment, or consider store closures. It is a key factor influencing pricing, profitability, and high street sustainability.

How do rising business rates affect food prices in the UK?

Rising business rates increase the fixed costs of operating supermarkets. To maintain profitability, retailers often pass these costs onto consumers. The uk supermarket business rates impact can therefore lead to higher prices for everyday groceries, contributing to food inflation and affecting household budgets across the UK.

Which supermarkets are most affected by the uk supermarket business rates impact?

Large supermarket chains such as Tesco, Sainsbury’s, Asda, and Morrisons are most affected. These retailers operate on relatively thin profit margins and face higher tax bills due to their property size. The uk supermarket business rates impact can force these chains to reconsider expansion, investment, or pricing strategies.

Can higher business rates lead to store closures?

Yes. The uk supermarket business rates impact may make some locations unprofitable, particularly larger stores with high overheads. To mitigate losses, supermarkets could close underperforming branches, reducing local access to groceries and affecting employment in the retail sector.

What is the government doing about the uk supermarket business rates impact?

The government has introduced certain reliefs and exemptions for smaller retailers, but large supermarkets face increases. Policymakers are under pressure from industry groups to address the uk supermarket business rates impact, as failure to act could worsen food inflation and negatively affect high streets and local economies.